Simple Summary

In 2019, in its early development stage, Fuse adopted an inflationary model to ensure certain predictability of the flow of revenue for network validators and delegators. Today, having acquired significant traction and use cases, the Network is ripe - especially in the current market conditions, to revisit its inflationary model and gradually transition towards deflation.

In controlling inflation and creating an equitable environment for projects to deploy, we build value into the network, which supports and builds the token price and reinforces stability and predictability.

To pursue the goal of deflationary tokenomics, Fuse is proposing the following:

Introducing gradual inflation reduction and max supply: transitioning to a deflationary model through a governance vote to gradually reduce inflation and set the max supply of FUSE tokens at 400,000,000 FUSE.

Fee burning: Implementing FIP-1559 base fee burn of 10 gwei (gasPrice).

If adopted, the proposed changes will result in a gradual, initiated reduction of the inflation rate, increased predictability concerning staking and rewards, and a first step towards a more sustainable model.

If adopted, subsequent FIPs will be published for a vote, and software updates will be made available to deploy the changes.

Introduction

The Fuse Network recently introduced the Fuse 2.0 Whitepaper that explains Fuse’s decision to focus on digital payment solutions for the “long-tail” of small and medium businesses globally will grow in importance over the coming years.

To help the network evolve into a valid alternative to legacy payments infrastructure that leverages the benefits of decentralization for businesses where it makes sense. Fuse is gradually introducing proposed changes to the Network. A necessary implication of the changes introduced to the Fuse Network is tokenomics.

Since the successful launch of Fuse 2.0, the Fuse team and community have discussed potential changes to improve the networks’ tokenomics and how to build our tokenomics around the relevant entities and stakeholders participating in the ecosystem.

Fuse investors and Validators are the foundational layers of the Fuse Network. They are motivated by and interested in the token price as their source of income and long-term investment returns.

The Fuse token price is also a metric that underpins the value of the Fuse blockchain ecosystem. A higher price brings greater market visibility, investor interest, partnership and development options, etc. Accordingly, the proposition below is designed to deliver an increase in token price through scarcity, reduced money supply, and slower velocity.

Seeking Engagement with the Proposal

The team and several contributors formed a tokenomics working group to refine this discussion and present a proposal to the community that could be implemented quickly. This proposal is the result of that discussion and reflects the input of many different community members; we are very grateful for the input of Rob Fuseprime and his assistance.

This proposal considers past discussions on the issues on the Forum and is designed to spark and encourage an engaging discussion.

To recall, in the past, the community supported deflation when the token price was low, but the spike in token prices halted discussions. The state of the market offers a prime opportunity to revise the issue.

moreover, like economies adjust inflation rates to accommodate market conditions, a Bear market necessitates more incentives and lower fees. In comparison, fewer incentives and higher fees are adequate for a Bull market.

We will solicit feedback from the community on this proposal with comments by 30 June 2023. Comments should be submitted in the forum. Based on that feedback, we will revise the proposal if needed and publish a thorough Tokenomics Design Paper and a roadmap for implementing the required changes.

If adopted, subsequent FIPs will be published for a vote, and software updates will be made available to deploy the voted-for changes.

FUSE v1 - The Initial Inflationary Model

Initial Supply

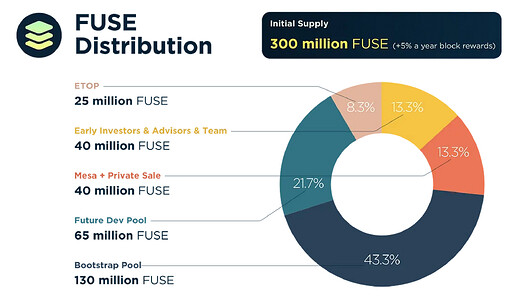

Fuse minted an initial supply of 300 million tokens in August 2019.

The following FUSE supply timeline graph depicts the total 5% annual inflation-adjusted supply of FUSE along a 4 year period and the corresponding total circulating supply:

Each cycle the validators with the highest amount of FUSE staked will split the rewards based on their proportional stake (awards commensurate with the staked amounts).

The rationale behind the inflationary model

With each new block created every 5 seconds on Fuse Network, the validator who creates it and the delegators who staked with them receive the block rewards in newly issued FUSE tokens.

This is designed to secure the network’s consensus mechanism. The reward amount per block is set so that the FUSE total supply increases by 5% yearly.

The main reason for choosing an inflationary model at the early development stage was to ensure certain predictability of the flow of revenue for network validators and delegators.

If they had to rely exclusively on transaction fees as the reward for staking FUSE and validating, it would be harder to predict their future returns, as transaction activity on the network can fluctuate.

The relative predictability of validator revenue is an essential assumption behind the blockchain consensus theory on which the Fuse consensus mechanism is based.

Having substantial block rewards also makes it possible to keep transaction fees on the network low, facilitating the adoption of Fuse.

FUSE v2: Transitioning from Fixed Inflation to Max Supply

As the Network moves forward, inflation becomes a negative pressure on the token, which needs to be justified to a broader range of investors and projects running on the network.

To pursue the goal of deflationary tokenomics that best serves all the Network’s participants, Fuse is proposing the transition from a fixed inflation rate to a fixed total supply.

While the proposed change in max supply will reduce staking rewards - albeit mildly and proportionately over time - the Fuse team nevertheless asserts that, overall, it is more beneficial for the Network and the ecosystem to potentially earn a lower APR with a potentially high-value token in a stable and well-used network, than a high APR with a low-value token in a fragile and unstable network, where the supply exceeds the demand.

The principles underlying the proposed change-

- As a financial ecosystem, it is sensible that the Fuse Network will have an easily understandable inflation structure. A simple and functional mechanism is the best solution.

- To be technically achievable and secure – not open to exploitation or abuse.

- To adapt to market changes, innovation, and developments without requiring hard forks or significant technical work.

- To create value for the token via scarcity.

- To continue to support validators and stakers while ensuring they are not disproportionally rewarded or unreasonably affected by the proposed changes.

After conducting thorough comparative research and assessing other potential avenues, the team asserts that the transition to a max supply of 400,000,000 FUSE and a gradual reduction of inflation, according to the specified below, offers the best solution.

1. Governance Vote: Setting a Max Supply of 400M FUSE and Gradual Inflation Reduction

In consideration of the current traction gained by the Fuse Network, the market situation, the strategic decision to reduce inflation for the reasons explained above, and other relevant factors, the Fuse team suggests that the inflation rate should be managed transparently and predictably by setting the max supply of FUSE tokens at 400,000,000 FUSE.

AS-IS Fuse Inflation Rate, Block Rewards, and Max Supply

“Fuse years” start/end around the end of August each year (depending on the number of blocks being minted - missed blocks extend the time).

Assume that 5% inflation equals 17M if the total supply is 351,394,068, and in a year, there are 17,280 * 365 = 6.3M blocks.

Then in each block, 17/6.3 ~ 2.78 Fuse is minted as block rewards.

Currently, there is no max supply of FUSE tokens.

Current Policy on Inflation Rate, Block Reward, and Max Supply

| inflation rate | total supply | max supply | New Fuse added a year | Fuse tokens minted per block - rewards | |

|---|---|---|---|---|---|

| 2023 | 5% | ~351,394,068 | - | ~17,569,703 | ~2.78 |

Simulation of Proposed Change (*rough approximations)

- The Supply of FUSE would be limited to 400M FUSE.

- Until August 2024, the inflation would remain at 5%.

- As of August 2024, the inflation rate would gradually reduce from a reduction to 3%.

- A 0.5% inflation rate will be maintained until a max supply of 400m FUSE is reached.

- Effectively, subject to other impacting factors (such as FIP 1559, see below), the network would approach a deflationary model (1%0%) circa 2027.

- The inflation rate would decrease in a controlled, fixed manner as of August 2024 to support stakers through the current bear market,

- Pushing for a gradual reduction to Max Supply within 7 years (~2030) will help push through FIP 1559 and other governance proposals.

- If the FUSE token price allows, a vote for an additional proactive reduction of inflation rates may be suitable.

| Period | Inflation | Total Supply | Minted Tokens |

|---|---|---|---|

| August 2023 → August 2024 | 5% | 355,700,000 | 17,785,000 |

| August 2024 → August 2025 | 3% | 373,485,000 | 11,204,550 |

| August 2025 → August 2026 | 1.5% | 384,689,550 | 5,770,343 |

| August 2026 → August 2027 | 1% | 390,459,893 | 3,904,599 |

| August 2027 → August 2028 | 0.75% | 394,364,492 | 2,957,734 |

| August 2028 → August 2029 | 0.5% | 397,322,226 | 1,986,611 |

| August 2029 → August 2030 | 0.5% | 399,308,837 | 1,996,544 |

| August 2030 → August 2031 | 0.5% | 400,000,000 | 2,000,000 |

| August 2031 → August 2032 | 0.5% | 400,000,000 | 2,000,000 |

| August 2032 → August 2033 | 0.5% | 400,000,000 | 2,000,000 |

Issues to consider: The road not taken

- The Fuse team considered the move to a 3% inflation already in August 2023 with immediate effect.

- This would mean that the Max Supply of Fuse would be reached ~ 2039 - within 16 years, as opposed to 7 years.

- However, pushing the Max Supply as late as 2039 weakens the case for FIP1559 (see below), and offers fewer benefits in the long run for the network.

- The team sees value in supporting its Validators and stakers through the current market while gradually setting the stage for impactful long-term changes.

The effect of the proposal on Validators, block rewards, and staking rewards

The implication of capping the max supply to adjust and gradually decrease the inflation rate results in decreased block rewards and affects staking rewards since the formula for calculating the rewards is comprised, among other factors, of the inflation rate and total supply of tokens.

As noted, the proposed change in max supply will reduce staking rewards - albeit mildly and proportionately over time. Nonetheless, it is more beneficial for the Network and the ecosystem to earn a lower APR with a high-value token in a stable and well-used network than a high APR with a low-value token in a fragile and unstable network, where the supply exceeds the demand.

Accordingly, this proposal seeks to reduce inflation in a managed, transparent manner while providing minimal inflation to cover Validators’ costs.

Block Rewards

- The proposal would affect block rewards since they are also calculated based on the inflation rate.

- The proposed gradual decrease in inflation would result in a mild decrease in block rewards, as simulated below

Staking Rewards

- The minimum staking threshold for Validator is 100k FUSE, while Node costs are ~ $30 (per calendar month).

- The proposal to decrease inflation and cap the max supply of FUSE tokens is designed to maintain Validator’s profitability for their 100k stake, which it currently is at ~$75 (per calendar month).

- When reaching the max supply of FUSE, circa 2030, with a 0.5% annual inflation rate, the implication, principally, is that 2,000,000 FUSE would be minted and distributed between Validators.

However, with the combination of FIP 1559 (below), the aspiration is that when reaching the max total supply, a sufficient amount of FUSE would be burned to mitigate the “tail” and result in an effectively close to a deflationary network.

At any rate, once inflation reaches 0.5%, it is crucial to evaluate the model to maintain proportionate rewards for Validators.

The projected rewards are calculated as follows:~~

- ~~Let **`T_s`** represent the total supply of FUSE tokens.~~

- ~~Let **`I`** represent the annual inflation rate (5% under the current policy, so 0.05 as a decimal).~~

- ~~Let **`T_st`** represent the total stake among all validators.~~

- ~~Let **`V_st`** represent the stake of a specific validator.~~

- ~~Let **`U_st`** represent the stake of a specific user within that validator.~~

- ~~Let **`F`** represent the validator's fee (e.g., 15% or 0.15 as a decimal).~~

~~Now, we can create a formula to calculate the projected rewards for a user who has delegated their tokens to a specific validator:~~

1. ~~Calculate the total annual rewards: **`A = T_s * I`**~~

2. ~~Calculate the validator's share of rewards based on its stake percentage: **`R_v = A * (V_st / T_st)`**~~

3. ~~Calculate the user's share before the validator's fee: **`R_u_pre_fee = R_v * (U_st / V_st)`**~~

4. ~~Calculate the user's projected rewards after the validator's fee: **`R_u = R_u_pre_fee * (1 - F)`**~~

~~So the final simplified equation for the user's projected rewards is:~~

**`~~R_u = T_s * I * (U_st / T_st) * (1 - F)~~`**

2. Introducing Fee Burning - FIP 1559

The Fuse team suggests implementing, with the necessary changes, the base fee and base fee burns following EIP 1559.

Under this proposal, the min gasPrice (10 gwei) will be burned, thereby contributing to the gradual deflation of the Network and the increased scarcity of FUSE.

If adopted, a subsequent FIP 1559 will be published for a vote, and software updates will be made available to deploy the voted-for changes.

The Current Policy on Gas Fees on Fuse:

The most straightforward transaction of FUSE from one account to another will need a minimum of 21,000 gas. Smart contract transactions require considerably more gas.

Following FIP 13, the minimum fee was increased to 10 gwei to mitigate the network against possible spamming attacks while preserving the attractiveness of low-cost transactions on the platform:

tx fee = gasAmount * gasPrice,

min gasAmount for a basic tx = 21,000

min gasPrice = 10 gwei

EIP 1559 in a nutshell: The goal of EIP-1559 was to improve traffic flow on the Ethereum network by setting a base fee for transactions and increasing the block size that holds these transactions. Increasing the block size allows for more transactions to be added, which results in less financial competition among users.

With a base fee for transactions in place, the bidding-first approach that existed pre-London Fork was removed. The base fee is the amount for any transaction to be added to the next block by a miner. This base fee will change by 12.5% over time based on the capacity of the block.

If a block is more than 50% full, it will be increased by 12.5%; if it is empty, it will be decreased by 12.5%. At 50% capacity, no changes will be made. The base fees are then burnt, decreasing inflation over time, as evidenced in this simulator.

Base fees on Fuse - FIP 1559

While the Fuse Network is gaining traction, it has yet to achieve the congestion level achieved by the Ethereum network before the London Fork. That said, EIP 1559 represents innovation, predictability, and flexibility, offering the Fuse Network additional paths to a more sustainable model that can withstand a higher level of popularity and demand in the market.

Under the present state of blocks created on the network, deployment of FIP 1559 will not significantly affect the network’s inflation. However, the current market state is a prime time to gradually implement a base fee model that will enter into full effect with the increase of transactions on the network.

Technically, introducing base fees and base fee burns does not necessitate excessive development effort, hardware changes, or high costs.

It is proposed that the gasPrice (10 gwei) will be burned so that:

- the user pays the same 10 gwei gasPrice - the tx does not become more expensive;

- the Network does not become more susceptible to spam chain attacks;

- Validators do not earn tx fees; they still earn block rewards;

- the burned gasPrice contributes to the increased scarcity of the token;

- over time, the network becomes more deflationary.

FAQs

What is tokenomics?

Tokenomics is a term derived from the combination of “token” and “economics,” which refers to the economic system and monetary policy of a specific cryptocurrency, token, or NFT. A tokenomics design involves creating rules and incentives that explain the issuance, distribution, and circulation of the tokens within the ecosystem.

Tokenomics includes various aspects, such as token supply, utility, and underlying technology. The token supply refers to the total number of tokens that will be created and how they will be distributed among different stakeholders.

Why is tokenomics important in cryptocurrency?

A project’s token economics play a critical role in defining its success in the long run. The main objective of a tokenomics design is to create a sustainable economic model for the tokens, ensure long-term supply, and inform potential investors about how the tokens will be distributed in the market.

What is EIP 1559?

EIP 1559 is a proposed improvement to the Ethereum blockchain that aims to simplify the process of setting transaction fees and make the network more efficient. The current system for setting transaction fees on the Ethereum network is complex and can lead to high fees during high network demand.

Under EIP 1559, the network would introduce a new type of transaction fee called a “base fee.” The network automatically sets the base fee based on the current demand for block space. It would be burned (destroyed) when the transaction is processed, effectively reducing the overall supply of Ethereum tokens.

In addition to the base fee, users could also choose to include a “tip” for the miner who processes their transaction. The tip would be paid directly to the miner as an incentive for including the transaction in the next block.

One of the benefits of this system is that it helps reduce transaction fees during times of high network demand, as the base fee would be adjusted automatically based on network congestion. This should make the network more efficient and reduce the need for users to pay high fees to have their transactions processed quickly.

What was the goal of EIP 1559?

EIP 1559 was implemented as part of the London hard fork on the Ethereum network, which occurred on August 5, 2021. The London hard fork was a significant update to the Ethereum network that introduced several new features and improvements, including EIP 1559.

Overall, the implementation of EIP 1559 has been widely regarded as a success, with the new fee structure and increased burning of ETH being seen as positive developments for the Ethereum network. However, there are still some concerns and criticisms around the fee-slashing mechanism, and it remains to be seen how effective it will be at preventing miner manipulation of the base fee.

What does it mean to burn tokens?

This means that the tokens are destroyed by protocol and removed from circulation, usually by sending the token to a particular type of address.

Are other networks implementing EIP 1559?

Yes. One example is Polygon which tested and deployed EIP 1559 as early as December 2021.

What is an inflationary network, and what is a deflationary network?

An inflationary blockchain network continuously grows in the number of tokens in supply, either because there is no fixed limit or because the limit is very high. An example of an inflationary blockchain network is Dogecoin, which has no supply cap and increases its circulation by millions of DOGE daily through its mining process.

A deflationary blockchain network has a decreasing number of tokens in supply, either because there is a low fixed limit or because some tokens are periodically burned or removed from circulation. An example of a deflationary blockchain network is BNB, which has a supply cap of 200 million BNB and burns some BNB every quarter based on its trading volume.

What are the pros and cons of inflation?

The pros and cons of having an inflationary or deflationary blockchain network depend on many factors that can affect the performance and adoption of crypto, such as its use case, technology, community, regulation, etc.

Very roughly speaking, outside the context of Fuse, some of the pros and cons of having an inflationary blockchain network are:

Pros:

- Inflationary networks can incentivize miners to secure the network and validate transactions by offering them rewards in new tokens.

- Inflationary networks can also encourage spending and circulation of the tokens rather than hoarding them for speculation.

- Inflationary networks can adjust their supply to meet the demand and avoid price volatility.

Cons:

- Inflationary networks can lose their value over time due to the dilution of the token supply and decreased purchasing power.

- Inflationary networks can also face competition from other cryptos that offer better returns or features.

- Inflationary networks can be vulnerable to manipulation or corruption by central authorities that control the token creation factor.

Some of the pros and cons of having a deflationary blockchain network are:

Pros:

- Deflationary networks can increase their value over time due to the scarcity of the token supply and the increase in purchasing power.

- Deflationary networks can also attract investors and savers who want to preserve or grow their wealth.

- Deflationary networks can create a sense of urgency and exclusivity among users who want to acquire the tokens before they run out.

Cons:

- Deflationary networks can discourage miners from securing the network and validating transactions by offering them lower rewards or fees in new tokens.

- Deflationary networks can also discourage spending and circulation of the tokens, leading to hoarding and speculation.

- Deflationary networks can face technical challenges or security risks due to the limited supply or the burning mechanism.

Are there other networks using max supply cap?

Some examples of blockchain networks with max supply limitations are:

Bitcoin: The most popular and widely used cryptocurrency network, it has a max supply of 21 million bitcoins. The last bitcoin is expected to be mined around the year 2140.

Ethereum: The second-largest cryptocurrency network by market capitalization, Ethereum has a max supply of no more than 120 million ether. However, this is not a hard cap but a social contract that can be changed by community consensus.

Litecoin: A fork of Bitcoin that aims to offer faster and cheaper transactions, Litecoin has a max supply of 84 million litecoins. The last litecoin is expected to be mined around the year 2142.

Monero: A privacy-focused cryptocurrency network that uses ring signatures and stealth addresses to obfuscate transactions, Monero has a max supply of 18.4 million monero. However, after reaching this limit, there will be a tail emission of 0.6 monero per block every two minutes to incentivize miners.

Cardano: A smart contract platform that aims to offer scalability, interoperability, and sustainability, Cardano has a max supply of 45 billion ADA. The network uses a proof-of-stake consensus mechanism called Ouroboros to secure and reward participants.